Your State Pension is likely to be a crucial part of your income in retirement, helping you to maintain your financial security. But so many people we speak to have never even checked their State Pension. So, in this blog, we uncover the main features of the State Pension and how to get your forecast, so you’re better prepared for your retirement.

Do you know whether your State Pension age is 66, 67 or 68? Did you know that based on national average statistics, a male can expect to live for a further 18-19 years and a female for a further 20-21 years? Therefore, your State Pension income will be paid out for a very long time. So, it’s important to know what you can expect and how to get the full amount if you’re likely to fall short.

How much State Pension will I get?

The State Pension is currently £179.60 per week, which is paid to your account every four weeks once you reach State Pension age. Based on current rules and depending on when you were born, this will be between 66 and 68 years. You can check your State Pension age using the following link:

https://www.gov.uk/state-pension-age

You will only have a forecast higher than £179.60 if, under the previous rules, you built up more than this before 06/04/2016.

How do I build up the state pension?

Your State Pension is funded from the National Insurance (NI) contributions you make while you’re working. The amount you will receive is based on your NI record, and not how much you earn each year.

To get the full Single-tier State Pension, which replaced the previous rules on 06/04/2016, you currently need 35 years of qualifying NI contributions or credits, when you reach your state pension age. This number of qualifying years will determine how much State Pension income you will receive in retirement. If you don’t manage to get the maximum 35 qualifying years, you’ll still get a proportion of the full amount based on the number of qualifying years you do have (subject to a minimum of 10 years).

For example, if you have 30 qualifying years, your State Pension would be £153.94 (£179.60 / 35 x 30) per week. If you’re a parent registered for child benefit for a child under 12, or you care for someone more than 20 hours a week, you’ll receive credits towards your State Pension. For more details about credits and your State Pension, see the following link:

https://www.nidirect.gov.uk/articles/getting-credits-towards-your-state-pension

What is a qualifying year?

If you’re employed, a qualifying year is when you’ve paid contributions on earnings of 52 times the Lower Earnings Limit (LEL). For the 2021-22 tax year, the LEL is £120 per week, so your paid salary would need to be at least £6,240.

If you’re self-employed, you will begin to pay NI contributions if your profits are above a threshold. For the 2021/22 tax year, this is £6,475, or you have the option to pay these if your profits are below.

State Pension forecast example

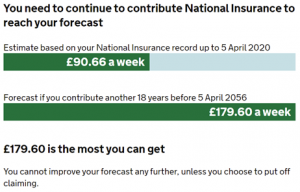

As you can see from my state pension details in the images above and below, although my forecast is £179.60 per week, the amount I have built up to 05/04/2021 is £90.66. So, I’d need another eighteen years to achieve the maximum £179.60 per week. If your forecast looks similar, and you plan to work less than the number of additional years required, you might need to consider the option of buying additional years. More notes about buying additional years are given below.

Maximising my State Pension

Anyone that has only built up years after 06/04/2016 will need a minimum of ten qualifying years to get any State Pension. So, as an extreme example, if you had nine qualifying years when you reached State Pension age, you wouldn’t be entitled to any State Pension. But if you voluntarily bought an extra year before reaching State Pension age, you would be entitled to £51.31 (£179.60 / 35 x 10) per week or £2,668 (£51.31 x 52) per year. Under the pre 06/04/2016 rules, only one qualifying year is needed.

There are a number of reasons why you might have gaps or part years, where you didn’t manage to get a full qualifying year. For example, perhaps you earned a low income, or you may have been unemployed and not claiming benefits.

It’s usually possible to pay voluntary contributions for the previous six years. As the yearly deadline is 5th April, you would have until 05/04/2022 to make up the gap for the 2015/16 tax year. Some people are able to fill gaps from earlier years and this is shown in your NI record.

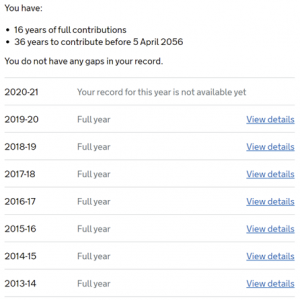

At the bottom of your State Pension forecast, there’s a link to see your NI record, which will look something like the image below.

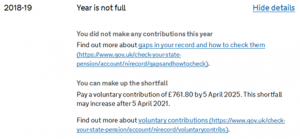

In the table above, every tax year is a full year. But if any of the previous years didn’t qualify, it would say ‘year is not full’. If you do have any of those, you can click on the ‘view details’ option on the right to see more details of that year, like in the example below.

As you can see, this gives you an idea of what you contributed towards a full year. You can also see the voluntary contribution that can be made before the deadline to buy the additional year.

Is it worth buying extra years?

In the example above, it would cost £761.80 to get the extra qualifying year. Each additional year is worth £5.13 (£179.60 / 35) of State Pension income per week or £266.76 (£5.13 x 52) per year. So it would take just under three years from when your State Pension starts to get back the amount you paid. Although, this does not take into account income tax or any State Pension increases. Don’t forget, based on the average life expectancy mentioned earlier, you could expect to receive this income for between 18 and 21 years. So, the amount you could potentially get back might be well worth the cost.

We often get asked if it’s worth buying extra years when the individual has, or is likely to have, 35 qualifying years. You can’t get more than the full Single-tier State Pension amount of £179.60, unless you’ve built up more before the new rules came into effect. So, buying extra years would not be of any benefit unless you wanted to gift your money to the UK government. But we doubt you would want to do that!

Defer the state pension

It’s possible to defer receiving your State Pension. If you reach the State Pension age after 06/04/2016 and want to increase the amount you’d get, you will need to defer taking your State Pension for a minimum of nine weeks. For every nine weeks you defer your State Pension, your State Pension will increase by 1%. So, this equates to an increase of just under 5.8% for each full year you defer taking the State Pension.

Does the State Pension increase?

Under current rules, the State Pension increases each year by the higher of inflation (CPI), average earnings, or 2.5%.

What happens if I pass away?

If you’re widowed or a surviving civil partner, you may be able to inherit an extra payment on top of your new State Pension. This is very much based on your individual circumstances when you or your spouse passes away, and whether the State Pension was built up under the new or old rules.

How to get my State Pension forecast and NI record?

Here is the link to get your State Pension Forecast from the Government Gateway website:

https://www.gov.uk/check-state-pension

To get your estimated State Pension details, click on the link above, then click on ‘start now’. If you have used the Government Gateway before, select the top options and sign in. If you haven’t used the Government Gateway before, you will need to choose the second or third option to create a Government Gateway account.

You can also find additional information about the state pension by using the following link:

We hope you found this information useful. Please let us know if there are any other aspects of financial planning you would like to learn more about.

Disclaimer – The Financial Conduct Authority does not regulate Tax Planning.